Non-Manufactured Precious Metal Trading

Jewellery Trading

Pearls & Precious Stones Trading

Our Mission

The long-standing knowledge and experience of our specialists, as well as our skills, allow us to react with great efficiency in order to offer the best possible product for our customers.

Our Plan

The continuous search for better quality products and services in order to satisfy the demands of our most demanding customers.

Our Vision

permanently maintaining a level of quality of our products and services offered to our customers is the secret of sustainable and responsible success

Our Engagement

Offer guaranteed quality products and services in collaboration with serious, responsible and committed partners

GOLD – THE PRECIOUS METAL

LIMITED SUPPLY

Gold has fascinated civilizations as early as the shiny metal was found in rivers and underground. It has also been coveted and obsessed over since the Mayan and Roman empires right up to modern times. Humans have been drawn to gold for many reasons: its emotional sustainability as an owned hard asset; its importance as a preferred fashion and decorative ornament; as a means of investment, wealth protection, and security; and to fulfill a growing demand with its industrial usage.

Knowing we can’t manufacture it, there will never be more gold than what the meteorites deposited on the planet millennia ago. This limitation of supply and the inability to manufacture this exclusive metal confers it a special value. It further attracts our instinctive willingness to associate this precious metal to a secured monetary value.

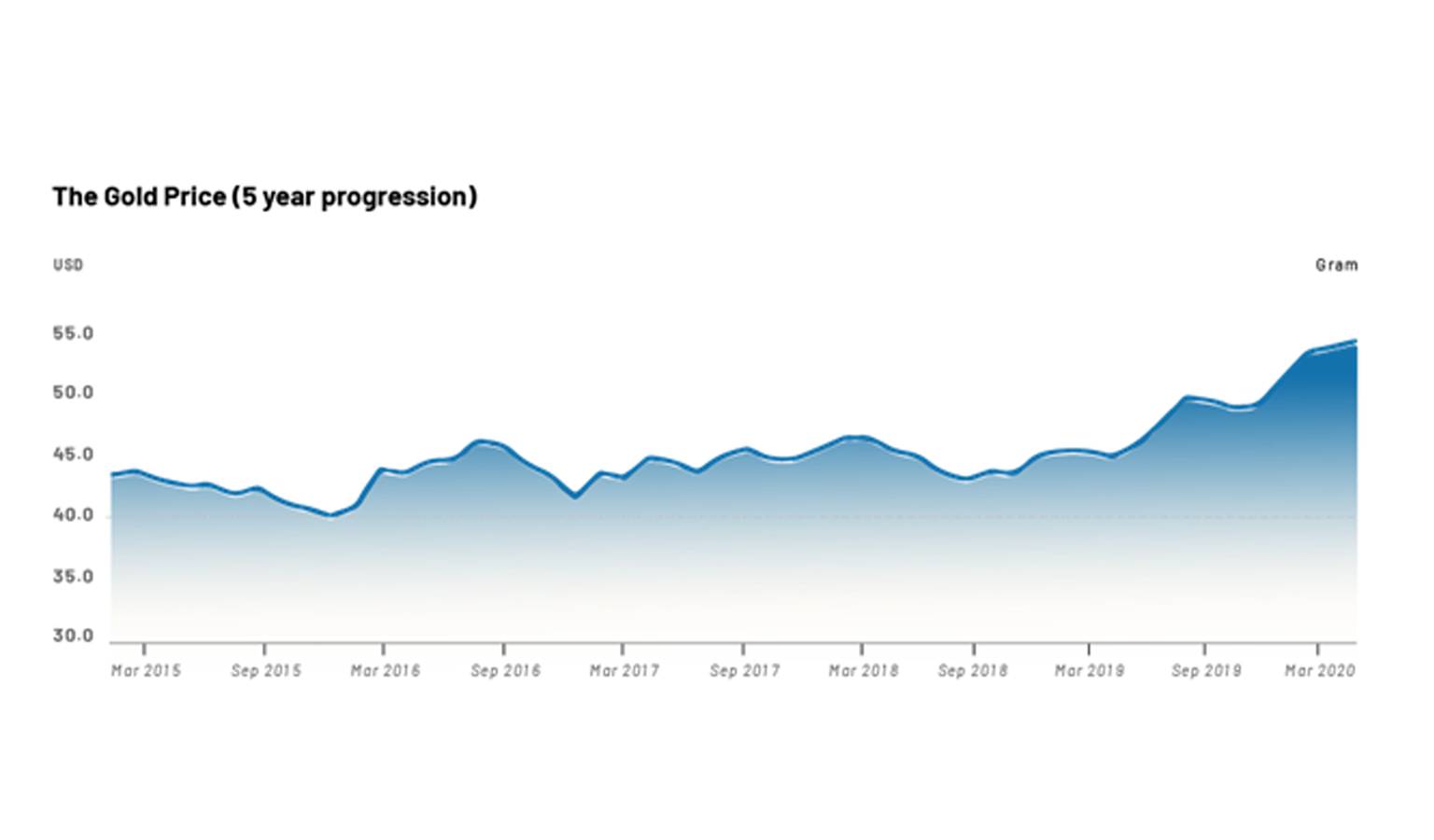

PRICE OF GOLD

2020 and 2021 will probably always be remembered as the years of the novel coronavirus (COVID-19). The global financial markets took a serious hit in March of 2020 amid the growing fears of its spread throughout the world. The price of gold wavered up and down during this month, but has remained stable compared to other asset groups.

The reason is that in times of economic uncertainty, investors often turn to gold as a hedge to protect their portfolios. Many economists believe the price of gold should be significantly higher right now. Popular economist Peter Schiff has said that many people underestimate the current monetary & fiscal policy mistakes, as well as the long term effects of the global pandemic, and “when they figure it out en masse, gold will skyrocket.”

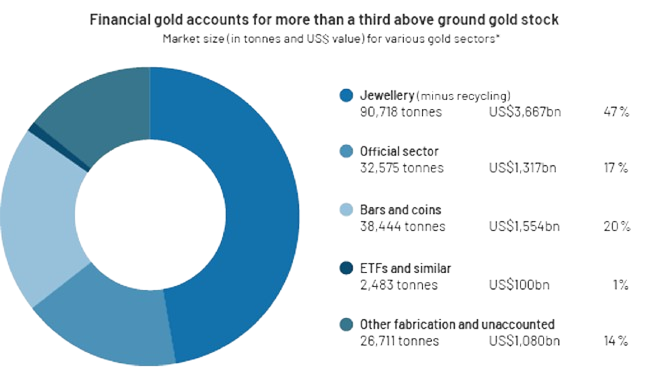

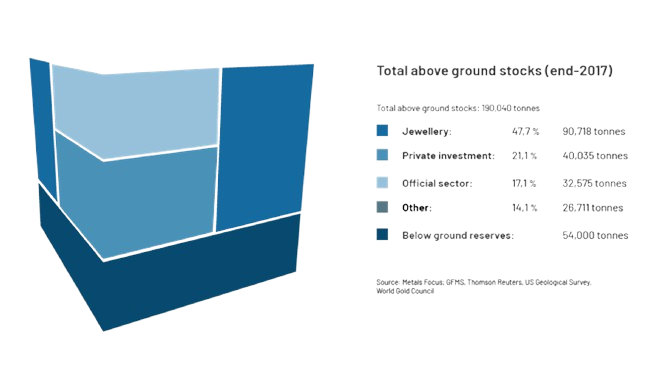

GOLD RESERVES

All the gold extracted since the beginning of recorded history (about 6,000 years) could fit in an area of 9000 cubic meters and would weigh about 190,000 tons. There are inventoried reserves for at least 54,000 tons still underground and classified as minable. And possibly much more is still not discovered.

PRICE OF GOLD

Annually, gold is extracted by two main groups: the industrial complex mostly constituted by large public companies (Barrick, Newmont, GoldCorp, AngloGold, etc.) and small mining operations worldwide. The latter consists of about 15-20 million miners, referred to as ASGM (artisanal small gold mining-operation). The main difference separating the two segments is the huge gap in the amount of starting capital they respectively have access to.

For many obvious reasons, ASGMs worldwide do not have access to traditional capital due to the nature of their operations, their geography, lack of formal business education and the usual socio-economic background of ASGM promoters.

Large public companies, on the other hand, have access to an abundance of capital required to build verye cient operations, thus making their extraction and treatment operations safer and more environmentally and socially sustainable - a luxury that ASGMs don’t have at present.

Contact

Our Address

Jewellery & Gemplex DMCC

Bg1, 2nd floor,Office N° 10-O2-D3

P.O BOX : 36853 Dubai U.A.E

Call Us

+ 971 (0)4 585 0443

+ 971 (0)58 661 2774

+ 971 (0)56 775 0993

Email Us

contact@dijadmcc.com